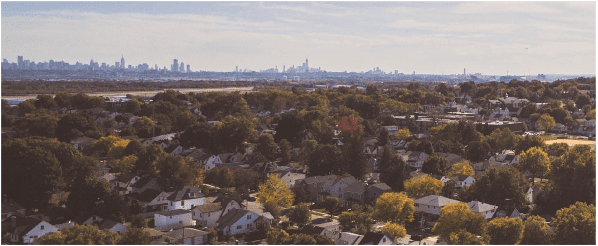

Home Ownership. It’s always been the Kiwi Dream, and most New Zealanders want to own their own home, usually a half-acre section, with a decent lawn to mow and somewhere for a vegetable garden. But lately it’s become just that – a dream. And a dream that’s slipping further and further from our fingers.

My parents have always regaled me with the tale of buying their first home: At 25, they bought a 3 bedroom villa with a subdividable section in a nice part of Auckland City, without any assistance from their parents. When I think about that now, it sounds like a fairy tale. Even my Dad now realises how much times have changed, because when the subject came up last time, he basically just said “oh yeah, you’re screwed”.

Home Ownership. It’s always been the Kiwi Dream, and most New Zealanders want to own their own home, usually a half-acre section, with a decent lawn to mow and somewhere for a vegetable garden. But lately it’s become just that – a dream. And a dream that’s slipping further and further from our fingers.

Why am I so screwed? When I look around, houses are selling faster than I can blink my eyes. Which means someone’s buying them. Why can’t I be the some-one doing the buying?

Supply & Demand

If you’re in the Management Faculty, you’ll know more about this concept that I can explain here. The concept of supply and demand really is simple though, and explains the interaction between the amount of a resource (or commodity) available, how much people want it, and the way this affects the price. If there aren’t many houses available, but everybody wants one, then the price goes up. People are willing to pay more for something in order to secure it. If there are loads of houses available, and no-one is that bothered about buying one, then the prices drop. People are prepared to shop around, or wait to get a good deal.

What we’re seeing at the moment then, is low supply, and high demand. There aren’t really enough houses in New Zealand, despite attempted government interventions (I’m eyeballing you, KiwiBuild), or at least not enough of the kind of houses that Kiwis want. While some cities, like New York, thrive on the apartment-culture, New Zealanders have a different idea of the lifestyle we want to live, and it involves a house. So, you take this low supply, and you add some high demand. A lot of people are wanting a house right now. While COVID-19 has impacted a lot of people’s income, it hasn’t been bad for everyone.

Housing Bubble

A housing bubble is defined as “a period of speculative purchases, where investors demonstrate willingness to pay a high price today because they believe that it will be as high (or higher) tomorrow.” Thanks Wikipedia. New Zealand is in a house price bubble right now, because people just keep paying more and more for the same house. You’d think that someone would see the 2 bedroom, run down villa, going for a million dollars in Auckland, and stop to say “I’m not buying this, it isn’t worth it”. Because we’re in a housing bubble though, right now, and for the imminent future, it is worth it. If you buy it now, but sell it on for the same, or more, tomorrow, then you’ve made money. At the moment, a lot of people are in a good position, where they can afford to pay these crazy prices, today, and tomorrow.

Between wage subsidies, increased NZ tourism, and some sales areas increasing, there are a lot of people in New Zealand who are still in a good, perhaps even better, position to buy property. Without other things to spend money on, travel being the big one, there are a lot of New Zealanders who are deciding to buckle down here, and buy a house now, while they’re stuck here. Then, there are the New Zealanders returning home, and you can see from the MIQ and immigration stats, that there’s a lot of them. Many kiwis who had been living and working overseas have saved enough for a deposit, and with the world crashing down around them have come home. So, you’re seeing them at the auctions too. But the third category, are the ones who are causing all the problems, the ones who really deserve your fury. The investors.

Property Investors

It’s easy to blame property investors for many of the housing market problems, and right now I’m going to. Buyers looking for an investment property are those who are already comfortably set up in their own home, usually working good jobs and making a decent income, but they want more money (I can’t entirely fault that, because I too want more money.) And they want more money without having to do much for it. So, to paraphrase Warren Buffett, they want their money, to make money. If you’ve already got a property, then you can use that as security and put another mortgage on it. Buy a rental property with that mortgage, say in Hamilton East, and have 4-5 students move in there. The students pay you rent, the rental income pays your mortgage, and before long you own another house completely freehold. Now you own two properties. Use both of those as security, take out two more mortgages, buy two more houses, rent them to more students… you get the idea. With so many investors out there snapping up properties, it’s hard for first home buyers to even get a look in. Unfortunately property investors aren’t the only issue us millennials are facing.

Resource Management Act

If it’s not just the money-hungry investors fucking up our property market, then what else is? The Resource Management Act (the “RMA”). The RMA is essentially a law that the government passed in 1991, designed to help New Zealand manage it’s air, water, and land resources in a way that will be good for the environment. It sounds sensible, but I can confirm that the RMA has been controversial from the day it was created, and that the view most people have of it is, to quote smeagol, “we hates it, we hates it forever”.

What’s so bad about the RMA? Honestly, a lot, but I don’t have enough room on this page to get into that. In fact, there’s probably not enough room in this magazine. The part it’s had to play in housing prices, however, is on the supply side of the equation. The RMA has limited the building of new houses. House prices have gone up, in part because the RMA made it so expensive for new developments to occur, or for any changes to the current status quo. The Housing Minister, Megan Woods, stated that the RMA has “resisted change in the local landscape and doesn’t recognise the benefits of urban development”. So even if New Zealanders were willing to step away from our quarter acre dream, and into an apartment, the RMA has made that very difficult.

Thankfully, as of February 2021 the government has promised to overhaul the RMA and replace it with some, hopefully, more effective legislation. That doesn’t solve the problem we’re facing right now, however.

Loans, deposits, and the Reserve Bank

Since you’ve made it this far, I’ll throw another complicating factor in the mix – Loan-to-Value Ratios (LVRs). When you’re looking to take out a mortgage, the LVR is the measure of how much a bank will lend you, in consideration of how much your property is worth. YThe most common ratio, sees you needing to have a 20% deposit to take out a mortgage, which is an LVR of 80%. If you have a high-LVR, then you’ve loan most of the value of the property, with a very small deposit going in, and not much equity. If you have a low-LVR, then you’ve either gone in with a large deposit, or already paid off a lot of your mortgage.

LVRs were imposed by the Reserve Bank, and were first introduced in October 2013. Initially, they helped to slow down housing market activity and the inflation of house prices, as you needed more money to buy a house. In response to COVID-19, LVR restrictions were removed in April 2020. The idea behind this was that in taking away LVR restrictions, any barriers to the COD-19 recovery efforts promoting cash flow would also be removed. The barriers were removed, but as you can see, chaos ensued. So, the LVR restrictions are now back. From 1 March 2021, restrictions have been reinstated for both home-buyers and investors, and from 1 May 2021 the LVR restrictions for investors will be raised again.

On one hand, while this will hopefully help to slow the demand for property, making it harder for investors to take out loans (although not for those who’ve already made good money, as they can keep on going), it’s also made it harder for first-home buyers to sneak into the market with a small deposit.

Home Ownership

What a seesaw. There’s a lot to consider when looking at the housing market, and the state of it today. I haven’t even really scratched the surface, but already there’s so much to balance – too many houses or not enough? High deposits or low deposits? How easy should it be to get a loan? Should I buy now, or later? If you’re seriously thinking about buying a house, then keep doing your research, and find the right time for you to make that leap. Then hang on tight, because you’ll be in for a wild ride. If you’re not ready yet, but want to know what the fuck we can do about the housing market, and how to fix it, then keep on reading…